Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

Buy-now-pay-later leader Sezzle shattered Q1 expectations with revenue surging 123% to $104.9M, as net income quadrupled to $36.2M. The fintech company raised 2025 guidance on strong performance across all metrics.

Sezzle Inc. (NASDAQ: SEZL) delivered exceptional first-quarter 2025 results that significantly exceeded analyst expectations, prompting substantial upward revisions to its full-year guidance.

Strong Q1 Performance

The company reported Gross Merchandise Volume (GMV) of $808.7 million for Q1 2025, representing a robust 64.1% year-over-year increase, driven by higher engagement from both Subscriber and On-Demand users.

Total Revenue reached a new quarterly record of $104.9 million, growing 123.3% year-over-year. The revenue as a percentage of GMV improved to 13.0%, surpassing the previous high of 11.5% achieved in Q4 2024. This performance substantially beat Wall Street’s expectations of $64.8 million, with the company benefiting from increased engagement and continued momentum from its WebBank partnership.

Operational Metrics Show Strong Consumer Adoption

Consumer engagement metrics were particularly impressive, with purchase frequency increasing to 6.1 times compared to 4.5 times in the previous year. The company reported 658,000 Monthly On-Demand & Subscribers (MODS) as of March 31, 2025, with a seasonal decline from 707,000 in Q4 2024, which is consistent with typical post-holiday shopping patterns.

Profitability and Efficiency Improvements

Operating expenses showed improved efficiency, increasing 66.0% year-over-year to $55.0 million but declining as a share of Total Revenue by 18.2 points to 52.4%. Transaction Related Costs as a percentage of GMV improved from 4.3% to 3.8% year-over-year, driven by better credit performance, effective payment processing strategies, and improved facility terms.

The company’s Operating Income surged 260.6% year-over-year to $49.9 million in Q1 2025, exceeding the previous record of $30.9 million in Q4 2024. Operating Margin expanded by 18.2 poBuy-now-pay-later leader Sezzle shattered Q1 expectations with revenue surging 123% to $104.9M, as net income quadrupled to $36.2M. The fintech company raised 2025 guidance on strong performance across all metricsints year-over-year to reach 47.6%. Net Income more than quadrupled year-over-year to $36.2 million, representing 34.5% of Total Revenue, with Earnings per Diluted Share reaching $1.00, up from $0.22 in the prior year.

Upgraded 2025 Guidance

In response to the strong quarterly performance, Sezzle has significantly raised its guidance for 2025:

Strategic Initiatives and Growth Drivers

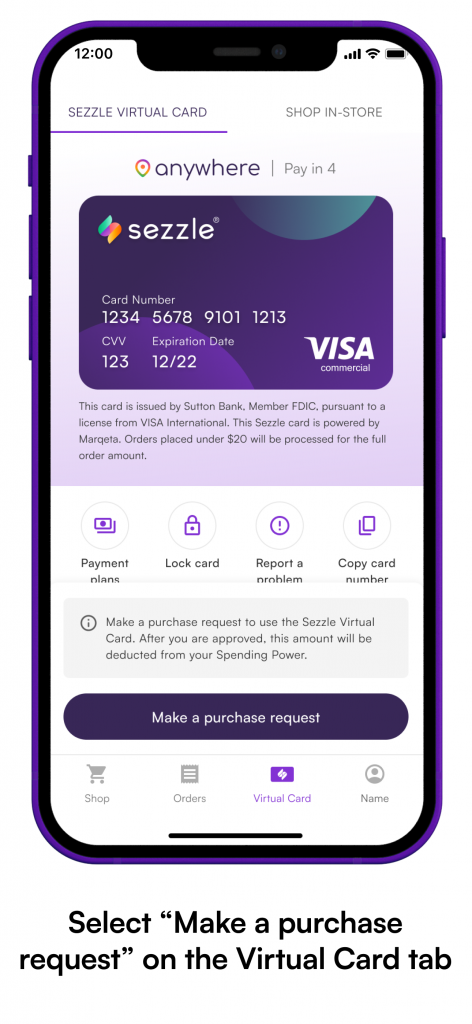

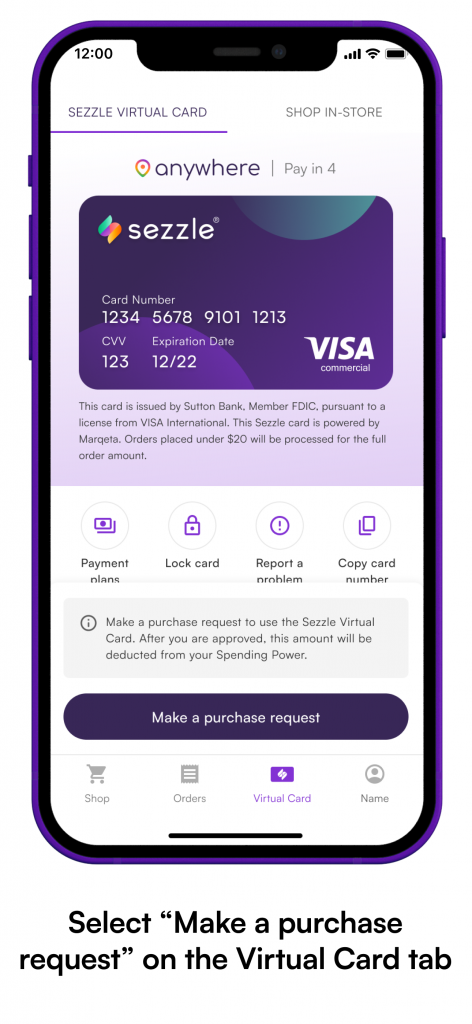

The company has launched several enhanced features to drive engagement and improve the shopping experience, including:

The company has also expanded its merchant network, adding notable partnerships with Scheels, a premium sporting goods retailer with over 30 U.S. locations, and WHOP, a growing digital marketplace for creators and online communities.

Market Impact and Future Outlook

The market responded positively to these results, with the stock surging 31.7% in extended trading. CEO Charlie Yeohkin noted that the company is benefiting from current consumer trends, stating, “Consumer sentiment is dropping, and many consumers seek out flexibility in their finances in uncertain times. BNPL provides that wanted flexibility and allows payments to be matched to budgets.”

The company’s financial position remains strong, with Cash Flow from Operations reaching $58.8 million in Q1 2025, up from $38.6M in Q1 2024. As of March 31, 2025, Sezzle maintained $120.9 million in cash and cash equivalents, with $32.0 million restricted, and had an outstanding principal balance of $70.8 million on its $150.0 million credit facility.

These results demonstrate Sezzle’s successful execution of its growth strategy and strong market position in the BNPL sector. The significant upward revision in guidance suggests management’s confidence in maintaining this momentum throughout 2025, while operational efficiency improvements indicate the company is successfully scaling its business model.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

Buy-now-pay-later leader Sezzle shattered Q1 expectations with revenue surging 123% to $104.9M, as net income quadrupled to $36.2M. The fintech company raised 2025 guidance on strong performance across all metrics.

Sezzle Inc. (NASDAQ: SEZL) delivered exceptional first-quarter 2025 results that significantly exceeded analyst expectations, prompting substantial upward revisions to its full-year guidance.

Strong Q1 Performance

The company reported Gross Merchandise Volume (GMV) of $808.7 million for Q1 2025, representing a robust 64.1% year-over-year increase, driven by higher engagement from both Subscriber and On-Demand users.

Total Revenue reached a new quarterly record of $104.9 million, growing 123.3% year-over-year. The revenue as a percentage of GMV improved to 13.0%, surpassing the previous high of 11.5% achieved in Q4 2024. This performance substantially beat Wall Street’s expectations of $64.8 million, with the company benefiting from increased engagement and continued momentum from its WebBank partnership.

Operational Metrics Show Strong Consumer Adoption

Consumer engagement metrics were particularly impressive, with purchase frequency increasing to 6.1 times compared to 4.5 times in the previous year. The company reported 658,000 Monthly On-Demand & Subscribers (MODS) as of March 31, 2025, with a seasonal decline from 707,000 in Q4 2024, which is consistent with typical post-holiday shopping patterns.

Profitability and Efficiency Improvements

Operating expenses showed improved efficiency, increasing 66.0% year-over-year to $55.0 million but declining as a share of Total Revenue by 18.2 points to 52.4%. Transaction Related Costs as a percentage of GMV improved from 4.3% to 3.8% year-over-year, driven by better credit performance, effective payment processing strategies, and improved facility terms.

The company’s Operating Income surged 260.6% year-over-year to $49.9 million in Q1 2025, exceeding the previous record of $30.9 million in Q4 2024. Operating Margin expanded by 18.2 poBuy-now-pay-later leader Sezzle shattered Q1 expectations with revenue surging 123% to $104.9M, as net income quadrupled to $36.2M. The fintech company raised 2025 guidance on strong performance across all metricsints year-over-year to reach 47.6%. Net Income more than quadrupled year-over-year to $36.2 million, representing 34.5% of Total Revenue, with Earnings per Diluted Share reaching $1.00, up from $0.22 in the prior year.

Upgraded 2025 Guidance

In response to the strong quarterly performance, Sezzle has significantly raised its guidance for 2025:

Strategic Initiatives and Growth Drivers

The company has launched several enhanced features to drive engagement and improve the shopping experience, including:

The company has also expanded its merchant network, adding notable partnerships with Scheels, a premium sporting goods retailer with over 30 U.S. locations, and WHOP, a growing digital marketplace for creators and online communities.

Market Impact and Future Outlook

The market responded positively to these results, with the stock surging 31.7% in extended trading. CEO Charlie Yeohkin noted that the company is benefiting from current consumer trends, stating, “Consumer sentiment is dropping, and many consumers seek out flexibility in their finances in uncertain times. BNPL provides that wanted flexibility and allows payments to be matched to budgets.”

The company’s financial position remains strong, with Cash Flow from Operations reaching $58.8 million in Q1 2025, up from $38.6M in Q1 2024. As of March 31, 2025, Sezzle maintained $120.9 million in cash and cash equivalents, with $32.0 million restricted, and had an outstanding principal balance of $70.8 million on its $150.0 million credit facility.

These results demonstrate Sezzle’s successful execution of its growth strategy and strong market position in the BNPL sector. The significant upward revision in guidance suggests management’s confidence in maintaining this momentum throughout 2025, while operational efficiency improvements indicate the company is successfully scaling its business model.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

Palantir’s strong earnings aren’t enough to counteract pressure from investors on its wildly inflated valuation — check out our analysis of their report.