Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

Here’s an expanded analysis of Shopify’s Q1 2025 performance: Shopify (NASDAQ, TSX: SHOP) demonstrated exceptional strength in Q1 2025, with financial results significantly outpacing market expectations and reinforcing its position as a global e-commerce leader.

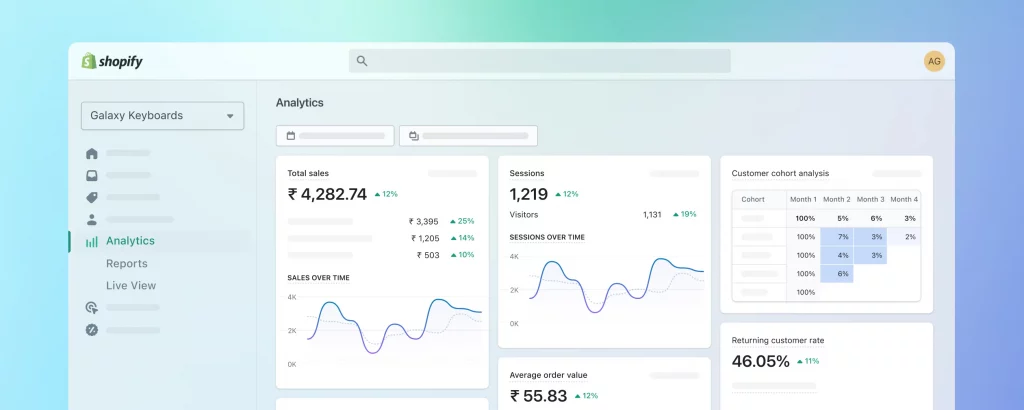

Financial Performance Highlights Revenue reached $2.36 billion in Q1, marking a 27% increase year-over-year and exceeding analyst consensus estimates of $2.13 billion. This performance represents the company’s eighth consecutive quarter of 25%+ pro forma revenue growth, demonstrating consistent execution in a competitive market landscape. Operating income more than doubled to $203 million from $86 million in the previous year, while operating margins expanded to 8.6% from 4.6%. The substantial improvement in profitability metrics reflects successful cost optimization initiatives and increasing platform efficiency.

Key Operational Metrics Gross Merchandise Value (GMV) grew to $74.75 billion, representing a 22% year-over-year increase. Monthly Recurring Revenue (MRR) reached $182 million, up 31% from the previous year, indicating strong merchant adoption and retention. The company reported several notable operational achievements:

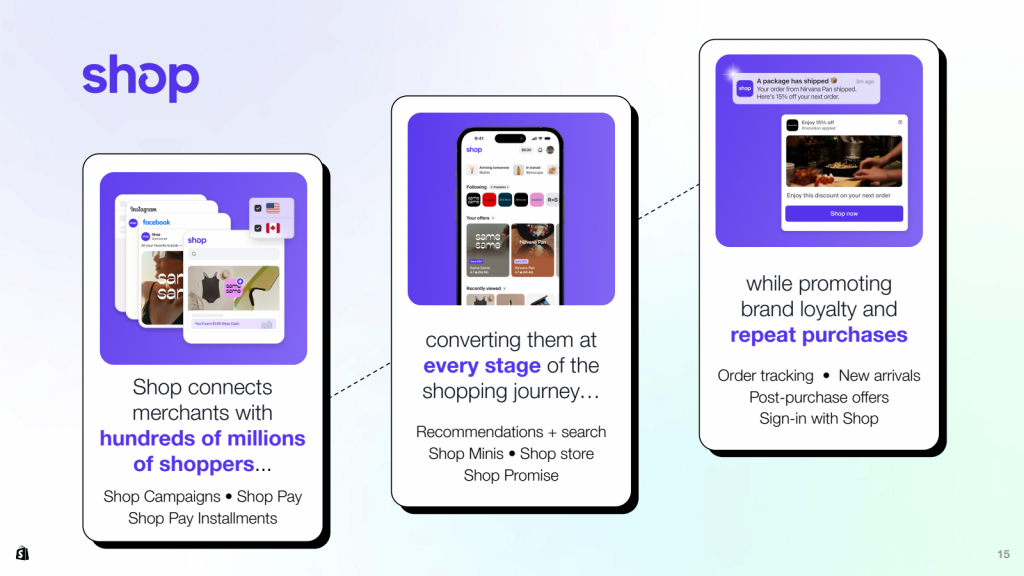

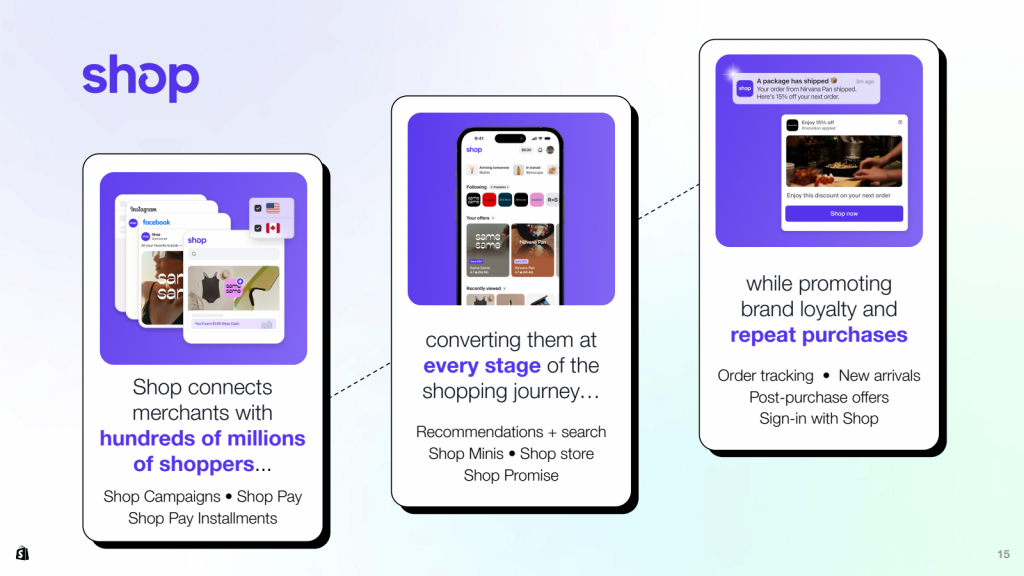

Strategic Initiatives and Platform Enhancement During Q1, Shopify launched several significant platform improvements:

Market Position and Competitive Landscape Shopify continues to strengthen its market position against both established players and emerging competitors. The company’s merchant base now exceeds 2.1 million active stores, with particularly strong growth in the enterprise segment through Shopify Plus. Notable competitive advantages include:

Financial Health and Balance Sheet The company maintains a strong financial position with:

Forward Guidance and Market Outlook Management provided optimistic guidance for Q2 2025:

Industry Trends and Macro Factors The e-commerce sector continues to evolve rapidly, with several key trends benefiting Shopify:

Risk Factors Despite strong performance, several risk factors warrant monitoring:

Analyst Perspectives Wall Street maintains a broadly positive outlook on Shopify, with 43 analysts providing coverage:

Management Commentary Harley Finkelstein, President of Shopify, emphasized the company’s resilience: “Our Q1 results confirm two clear facts. First, we are delivering both growth and profitability at scale. Second, businesses perform better on Shopify, regardless of market conditions.” CEO Tobias Lütke added: “We’re seeing strong adoption across our entire platform, particularly in enterprise solutions and international markets. Our investments in AI and automation are delivering measurable value to merchants of all sizes.” This comprehensive performance in Q1 2025 demonstrates Shopify’s successful execution of its growth strategy while maintaining profitability. The company’s continued innovation, strong merchant adoption, and expanding global presence position it well for sustained growth in the evolving e-commerce landscape.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

Buy-now-pay-later leader Sezzle shattered Q1 expectations with revenue surging 123% to $104.9M, as net income quadrupled to $36.2M. The fintech company raised 2025 guidance on strong performance across all metrics.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

Here’s an expanded analysis of Shopify’s Q1 2025 performance: Shopify (NASDAQ, TSX: SHOP) demonstrated exceptional strength in Q1 2025, with financial results significantly outpacing market expectations and reinforcing its position as a global e-commerce leader.

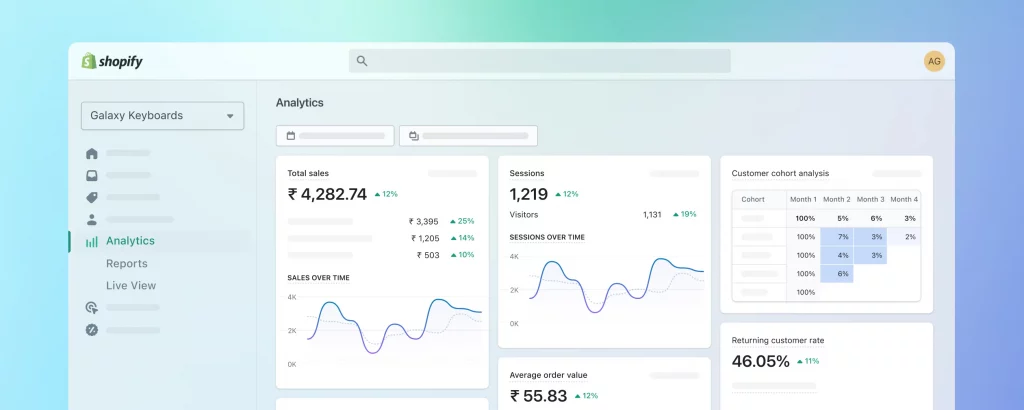

Financial Performance Highlights Revenue reached $2.36 billion in Q1, marking a 27% increase year-over-year and exceeding analyst consensus estimates of $2.13 billion. This performance represents the company’s eighth consecutive quarter of 25%+ pro forma revenue growth, demonstrating consistent execution in a competitive market landscape. Operating income more than doubled to $203 million from $86 million in the previous year, while operating margins expanded to 8.6% from 4.6%. The substantial improvement in profitability metrics reflects successful cost optimization initiatives and increasing platform efficiency.

Key Operational Metrics Gross Merchandise Value (GMV) grew to $74.75 billion, representing a 22% year-over-year increase. Monthly Recurring Revenue (MRR) reached $182 million, up 31% from the previous year, indicating strong merchant adoption and retention. The company reported several notable operational achievements:

Strategic Initiatives and Platform Enhancement During Q1, Shopify launched several significant platform improvements:

Market Position and Competitive Landscape Shopify continues to strengthen its market position against both established players and emerging competitors. The company’s merchant base now exceeds 2.1 million active stores, with particularly strong growth in the enterprise segment through Shopify Plus. Notable competitive advantages include:

Financial Health and Balance Sheet The company maintains a strong financial position with:

Forward Guidance and Market Outlook Management provided optimistic guidance for Q2 2025:

Industry Trends and Macro Factors The e-commerce sector continues to evolve rapidly, with several key trends benefiting Shopify:

Risk Factors Despite strong performance, several risk factors warrant monitoring:

Analyst Perspectives Wall Street maintains a broadly positive outlook on Shopify, with 43 analysts providing coverage:

Management Commentary Harley Finkelstein, President of Shopify, emphasized the company’s resilience: “Our Q1 results confirm two clear facts. First, we are delivering both growth and profitability at scale. Second, businesses perform better on Shopify, regardless of market conditions.” CEO Tobias Lütke added: “We’re seeing strong adoption across our entire platform, particularly in enterprise solutions and international markets. Our investments in AI and automation are delivering measurable value to merchants of all sizes.” This comprehensive performance in Q1 2025 demonstrates Shopify’s successful execution of its growth strategy while maintaining profitability. The company’s continued innovation, strong merchant adoption, and expanding global presence position it well for sustained growth in the evolving e-commerce landscape.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

Buy-now-pay-later leader Sezzle shattered Q1 expectations with revenue surging 123% to $104.9M, as net income quadrupled to $36.2M. The fintech company raised 2025 guidance on strong performance across all metrics.

Palantir’s strong earnings aren’t enough to counteract pressure from investors on its wildly inflated valuation — check out our analysis of their report.