Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

After reporting great news involving launch plans for broadband satellites and securing a key contract, ASTS stock is down 17% after hours. Why?

AST SpaceMobile’s recent Q3 2024 report provides insight into its financial health, operational achievements, and strategic positioning, further clarifying its potential as an investment. Here’s a deeper dive, incorporating insights from both the uploaded document and external sources.

According to AST’s Q3 2024 financials, the company holds $518.9 million in cash and restricted cash, a significant increase from $287.6 million in Q2 2024. This robust liquidity was boosted by strategic warrant redemptions and its ATM program. Despite this financial cushion, AST continues to navigate high operating expenses, reporting adjusted operating expenses of $45.3 million in Q3, up from $34.6 million in Q2, reflecting increased investments in engineering, research and development (R&D), and general administration.

AST SpaceMobile has made substantial progress with its Block 1 BlueBird satellite launches, reporting successful initial operations of its first five commercial satellites. Additionally, the company has secured agreements with major launch providers such as SpaceX, ISRO, and now Blue Origin, setting the stage for more ambitious Block 2 deployments. These moves are intended to support AST’s goal of creating uninterrupted space-based broadband coverage across key regions like the U.S., Europe, and Japan.

Beyond technical achievements, AST has strengthened its ecosystem with the addition of three new U.S. government contracts and deepened its commercial relationships, including partnerships with global telecom players AT&T and Verizon. These developments position AST SpaceMobile to capitalize on a dual-use approach, serving both commercial telecom needs and secure government communication requirements, a dual strategy that could amplify revenue sources while diversifying risk.

Despite a promising outlook, AST faces significant execution risks:

To further evaluate AST SpaceMobile as an investment, let’s explore additional financial, technological, and strategic dimensions:

AST’s Q3 2024 report reveals continued investments in its foundational infrastructure, particularly through its capital expenditure of $26.5 million on property and equipment, which indicates the company’s commitment to scaling its satellite network. Analysts suggest that AST’s long-term viability hinges on effective management of these capital-intensive activities, projecting that AST could start generating substantial revenue once its beta services transition to full commercial deployment. While revenue projections of up to $5 billion by 2030 are promising, AST remains in a pre-revenue stage, which increases the pressure on its current liquidity and necessitates careful expense management until positive cash flow is achieved.

AST has positioned itself as the only company aiming to provide broadband service directly to standard mobile devices via satellite, bypassing the need for specialized ground stations or modified user devices. In 2024, AST successfully unfolded and activated its first five BlueBird satellites, marking a key milestone towards its ultimate goal of a fully operational satellite network. These satellites use a large, unique phased-array antenna to link directly with terrestrial mobile networks, a breakthrough in satellite telecommunications technology.

The upcoming deployment of Block 2 BlueBird satellites in 2025 and 2026 is expected to enable global, continuous broadband coverage, supported by AST’s partnerships with major launch providers like SpaceX and Blue Origin. However, the company’s ability to deploy these satellites on schedule will be crucial for maintaining investor confidence, as delays could impact revenue timelines and investor sentiment.

The global satellite internet market is projected to reach $30 billion by 2030, driven by increasing demand for connectivity in underserved areas and advancements in satellite technology. AST has a competitive advantage in targeting the mobile network operator (MNO) market, with established contracts involving AT&T, Verizon, and Vodafone. By providing MNOs with wholesale broadband services, AST has the potential to address connectivity for billions of subscribers.

Competitors like SpaceX’s Starlink and Amazon’s Project Kuiper focus primarily on direct-to-consumer internet, which could indirectly complement AST’s business-to-business model by meeting different market needs. However, both competitors bring potential challenges as they continue advancing their satellite capabilities and expanding service offerings globally.

While AST is strategically positioned, it faces risks related to execution, regulatory approvals, and competitive pressures:

AST SpaceMobile’s focus on space-based mobile broadband could make it a transformative force in global connectivity, addressing billions of underserved users and supporting government, commercial, and public service applications. Its innovative technology, strategic partnerships, and financial backing give it substantial growth potential, though the investment comes with a high degree of uncertainty given the company’s capital demands and operational risks.

For investors, AST SpaceMobile offers a high-risk, high-reward profile: its market opportunity is vast, but success will depend on its ability to execute its ambitious satellite launches, navigate regulatory landscapes, and scale sustainably. As such, AST SpaceMobile may be most suitable for risk-tolerant investors looking for exposure to next-generation telecom and satellite technology.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

After reporting great news involving launch plans for broadband satellites and securing a key contract, ASTS stock is down 17% after hours. Why?

AST SpaceMobile’s recent Q3 2024 report provides insight into its financial health, operational achievements, and strategic positioning, further clarifying its potential as an investment. Here’s a deeper dive, incorporating insights from both the uploaded document and external sources.

According to AST’s Q3 2024 financials, the company holds $518.9 million in cash and restricted cash, a significant increase from $287.6 million in Q2 2024. This robust liquidity was boosted by strategic warrant redemptions and its ATM program. Despite this financial cushion, AST continues to navigate high operating expenses, reporting adjusted operating expenses of $45.3 million in Q3, up from $34.6 million in Q2, reflecting increased investments in engineering, research and development (R&D), and general administration.

AST SpaceMobile has made substantial progress with its Block 1 BlueBird satellite launches, reporting successful initial operations of its first five commercial satellites. Additionally, the company has secured agreements with major launch providers such as SpaceX, ISRO, and now Blue Origin, setting the stage for more ambitious Block 2 deployments. These moves are intended to support AST’s goal of creating uninterrupted space-based broadband coverage across key regions like the U.S., Europe, and Japan.

Beyond technical achievements, AST has strengthened its ecosystem with the addition of three new U.S. government contracts and deepened its commercial relationships, including partnerships with global telecom players AT&T and Verizon. These developments position AST SpaceMobile to capitalize on a dual-use approach, serving both commercial telecom needs and secure government communication requirements, a dual strategy that could amplify revenue sources while diversifying risk.

Despite a promising outlook, AST faces significant execution risks:

To further evaluate AST SpaceMobile as an investment, let’s explore additional financial, technological, and strategic dimensions:

AST’s Q3 2024 report reveals continued investments in its foundational infrastructure, particularly through its capital expenditure of $26.5 million on property and equipment, which indicates the company’s commitment to scaling its satellite network. Analysts suggest that AST’s long-term viability hinges on effective management of these capital-intensive activities, projecting that AST could start generating substantial revenue once its beta services transition to full commercial deployment. While revenue projections of up to $5 billion by 2030 are promising, AST remains in a pre-revenue stage, which increases the pressure on its current liquidity and necessitates careful expense management until positive cash flow is achieved.

AST has positioned itself as the only company aiming to provide broadband service directly to standard mobile devices via satellite, bypassing the need for specialized ground stations or modified user devices. In 2024, AST successfully unfolded and activated its first five BlueBird satellites, marking a key milestone towards its ultimate goal of a fully operational satellite network. These satellites use a large, unique phased-array antenna to link directly with terrestrial mobile networks, a breakthrough in satellite telecommunications technology.

The upcoming deployment of Block 2 BlueBird satellites in 2025 and 2026 is expected to enable global, continuous broadband coverage, supported by AST’s partnerships with major launch providers like SpaceX and Blue Origin. However, the company’s ability to deploy these satellites on schedule will be crucial for maintaining investor confidence, as delays could impact revenue timelines and investor sentiment.

The global satellite internet market is projected to reach $30 billion by 2030, driven by increasing demand for connectivity in underserved areas and advancements in satellite technology. AST has a competitive advantage in targeting the mobile network operator (MNO) market, with established contracts involving AT&T, Verizon, and Vodafone. By providing MNOs with wholesale broadband services, AST has the potential to address connectivity for billions of subscribers.

Competitors like SpaceX’s Starlink and Amazon’s Project Kuiper focus primarily on direct-to-consumer internet, which could indirectly complement AST’s business-to-business model by meeting different market needs. However, both competitors bring potential challenges as they continue advancing their satellite capabilities and expanding service offerings globally.

While AST is strategically positioned, it faces risks related to execution, regulatory approvals, and competitive pressures:

AST SpaceMobile’s focus on space-based mobile broadband could make it a transformative force in global connectivity, addressing billions of underserved users and supporting government, commercial, and public service applications. Its innovative technology, strategic partnerships, and financial backing give it substantial growth potential, though the investment comes with a high degree of uncertainty given the company’s capital demands and operational risks.

For investors, AST SpaceMobile offers a high-risk, high-reward profile: its market opportunity is vast, but success will depend on its ability to execute its ambitious satellite launches, navigate regulatory landscapes, and scale sustainably. As such, AST SpaceMobile may be most suitable for risk-tolerant investors looking for exposure to next-generation telecom and satellite technology.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

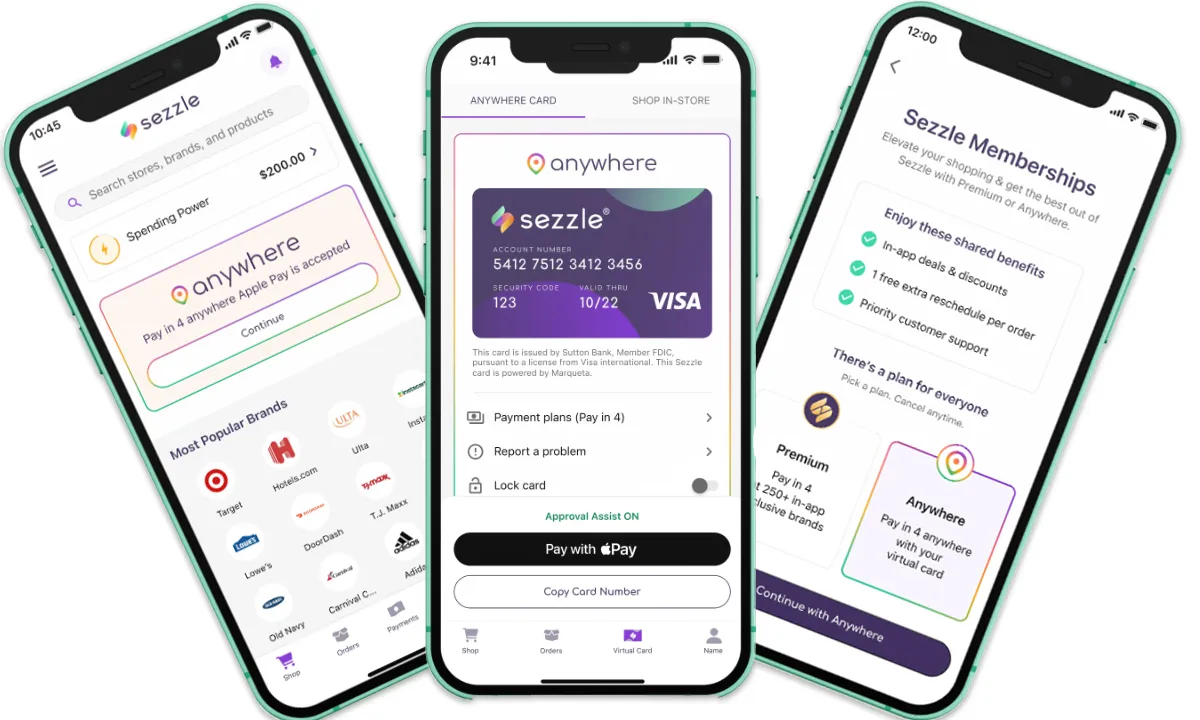

Buy-now-pay-later leader Sezzle shattered Q1 expectations with revenue surging 123% to $104.9M, as net income quadrupled to $36.2M. The fintech company raised 2025 guidance on strong performance across all metrics.