Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

In a frenzied 5G airway spectrum, carriers such as Verizon, AT&T, T-Mobile and Charter have broken spending records for cellular capacity.

In a frenzied 5G airway spectrum, carriers such as Verizon, AT&T, T-Mobile and Charter have broken spending records for cellular capacity.

Recent bidding for America’s coveted 5G airways has recently passed $76.5 billion in bids, fueled by an incredible desire to boast the largest 5G service. Providers like Verizon Communications, AT&T, T-Mobile, Dish, Comcast, and Charter are all fighting over coveted spectrum that allows them to send data over a specific wavelength.

The auction, run by the FCC, started just last month, with a total of 57 bidders. Within a few days, the total bid by those companies had past $47 billion, already besting expectations by the industry’s analysts. As an example, the top FCC airwaves in 2015 attracted $45 billion in bids. Compare that to the $47 that had already happened within a few days, and you can see that 5G waves were really something to bid for.

The current sale of ‘C-band’ spectrum could reach as much as $80 billion within the new week or so, besting any sort of record that had come before.

With the massive amount of money flowing into these auctions, it really emphasizes how determined these companies are at gaining control of the best parts of the 5G bandwidth. It’s expected for these airwaves to drive a massive surge in profits, deploying across a growing market of IoT devices.

Director of Broadband and Spectrum Policy at the IT & Innovation Foundation, Doug Brake, has said that “It’s great spectrum, there’s a lot of it, and it’s coming right as carriers are gearing up to get ready for 5G.”

Originally, Verizon was expected to be the heavyweight of the auction, backed by high profits and growing revenues. They also happen to have a war chest of goodies and cash that the company’s been saving up for a while, which contributed further to their heavyweight disposition.

That was before T-Mobile started chipping in higher bids for a greater spectrum, something that really wasn’t expected, from the once lowest-growing service provider.

Thanks to the financial powerhouse that is T-Mobile’s majority holder, Deutsche Telekom AG, the company’s been able to spend much more on 5G airways than previously anticipated. That puts Verizon’s 5G prowess into question, as T-Mobile currently has the furthest reaching 5G and best speeds on average.

Verizon has the fastest speeds when it comes to shortband 5G, essentially shorter distance but higher speeds. They struggle when it comes to long distance, as most of the time, their long-distance speeds are either barely above 4G, or even below 4G.

According to a New Street Research analyst, T-Mobile has “a powerful network advantage today, and they may extend it.” That follows recent shakeups within the top cellular services, as AT&T had just recently become number 3, behind Verizon and T-Mobile.

According to multiple reports, the highest bidders, likely Verizon, AT&T, T-Mobile, Dish, and Comcast, have about $70 billion in cash available for bidding. That was at the beginning of the auction, obviously having likely burnt up at almost $80 billion has been bid so far.

It’s expected that the companies are to “tap the bond market in early 2021,” as their funds, cash, and some expendable assets dry up. Spectrum airways are incredibly expensive as it is, but 5G becomes even more expensive due to the sheer stress these airways can contain.

In addition to the prices paid for these 5G licenses, the winning bidders of the auctions will have to also pay an estimated $13 billion or even more, to the current users of 5G spectrums. Most of the owned spectrum belongs to Intelsat SA or SES SA. These satellite companies would have to change their frequencies to make room for additional users on the signals.

Overall, these bids for the auction are record breaking, and are pushing even higher. This is likely going to make the fight between various service providers even more tight, unless T-Mobile uses the power of Deutsche Telekom to its fullest potential.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

In a frenzied 5G airway spectrum, carriers such as Verizon, AT&T, T-Mobile and Charter have broken spending records for cellular capacity.

In a frenzied 5G airway spectrum, carriers such as Verizon, AT&T, T-Mobile and Charter have broken spending records for cellular capacity.

Recent bidding for America’s coveted 5G airways has recently passed $76.5 billion in bids, fueled by an incredible desire to boast the largest 5G service. Providers like Verizon Communications, AT&T, T-Mobile, Dish, Comcast, and Charter are all fighting over coveted spectrum that allows them to send data over a specific wavelength.

The auction, run by the FCC, started just last month, with a total of 57 bidders. Within a few days, the total bid by those companies had past $47 billion, already besting expectations by the industry’s analysts. As an example, the top FCC airwaves in 2015 attracted $45 billion in bids. Compare that to the $47 that had already happened within a few days, and you can see that 5G waves were really something to bid for.

The current sale of ‘C-band’ spectrum could reach as much as $80 billion within the new week or so, besting any sort of record that had come before.

With the massive amount of money flowing into these auctions, it really emphasizes how determined these companies are at gaining control of the best parts of the 5G bandwidth. It’s expected for these airwaves to drive a massive surge in profits, deploying across a growing market of IoT devices.

Director of Broadband and Spectrum Policy at the IT & Innovation Foundation, Doug Brake, has said that “It’s great spectrum, there’s a lot of it, and it’s coming right as carriers are gearing up to get ready for 5G.”

Originally, Verizon was expected to be the heavyweight of the auction, backed by high profits and growing revenues. They also happen to have a war chest of goodies and cash that the company’s been saving up for a while, which contributed further to their heavyweight disposition.

That was before T-Mobile started chipping in higher bids for a greater spectrum, something that really wasn’t expected, from the once lowest-growing service provider.

Thanks to the financial powerhouse that is T-Mobile’s majority holder, Deutsche Telekom AG, the company’s been able to spend much more on 5G airways than previously anticipated. That puts Verizon’s 5G prowess into question, as T-Mobile currently has the furthest reaching 5G and best speeds on average.

Verizon has the fastest speeds when it comes to shortband 5G, essentially shorter distance but higher speeds. They struggle when it comes to long distance, as most of the time, their long-distance speeds are either barely above 4G, or even below 4G.

According to a New Street Research analyst, T-Mobile has “a powerful network advantage today, and they may extend it.” That follows recent shakeups within the top cellular services, as AT&T had just recently become number 3, behind Verizon and T-Mobile.

According to multiple reports, the highest bidders, likely Verizon, AT&T, T-Mobile, Dish, and Comcast, have about $70 billion in cash available for bidding. That was at the beginning of the auction, obviously having likely burnt up at almost $80 billion has been bid so far.

It’s expected that the companies are to “tap the bond market in early 2021,” as their funds, cash, and some expendable assets dry up. Spectrum airways are incredibly expensive as it is, but 5G becomes even more expensive due to the sheer stress these airways can contain.

In addition to the prices paid for these 5G licenses, the winning bidders of the auctions will have to also pay an estimated $13 billion or even more, to the current users of 5G spectrums. Most of the owned spectrum belongs to Intelsat SA or SES SA. These satellite companies would have to change their frequencies to make room for additional users on the signals.

Overall, these bids for the auction are record breaking, and are pushing even higher. This is likely going to make the fight between various service providers even more tight, unless T-Mobile uses the power of Deutsche Telekom to its fullest potential.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

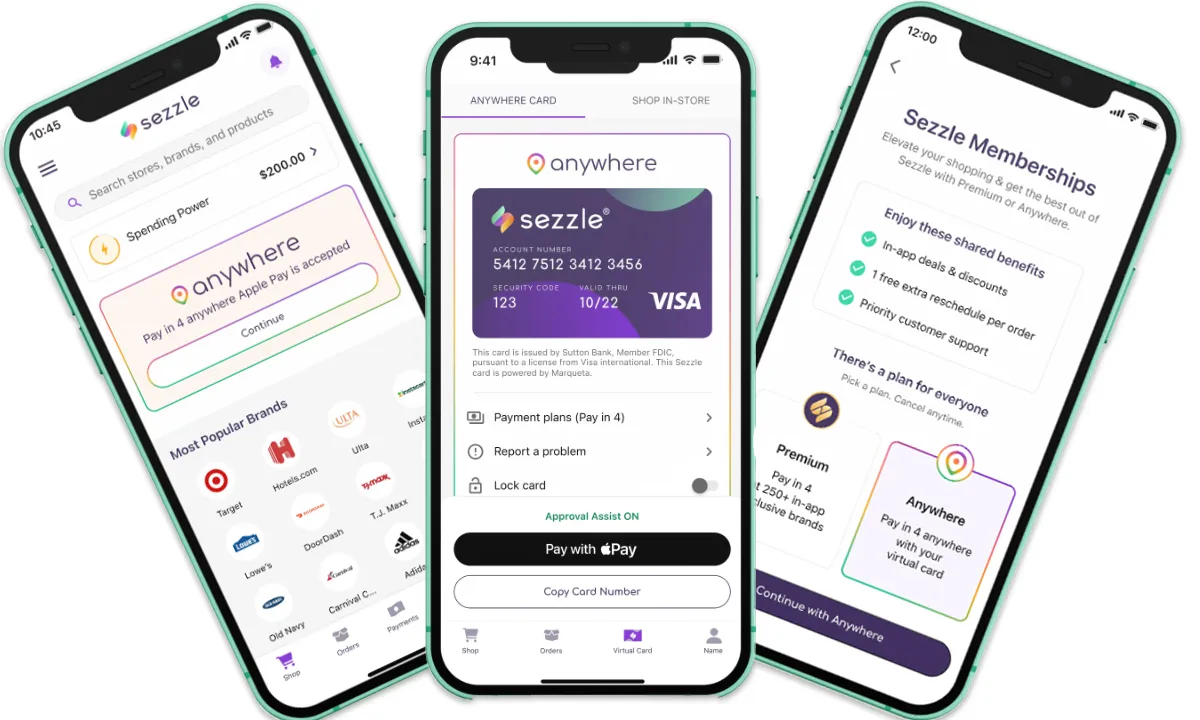

Buy-now-pay-later leader Sezzle shattered Q1 expectations with revenue surging 123% to $104.9M, as net income quadrupled to $36.2M. The fintech company raised 2025 guidance on strong performance across all metrics.