Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

The fitness equipment company with a strong support base received incredible growth during the pandemic. Here’s why I think that’ll continue.

The fitness equipment company with a strong support base received incredible growth during the pandemic. Here’s why I think that’ll continue.

The fitness equipment company with a strong support base received incredible growth during the pandemic. Here’s why I think that’ll continue.

Peloton, the at-home fitness equipment company (NASDAQ: PTON) has seen its market cap fall by roughly 20% from the past month’s high to its current stock price, after news surrounding vaccines and a return to a pre-COVID world scared many share owners.

The reason behind that drop was due to Peloton’s growth during the pandemic. Naturally, a stay-at-home order/quarantine would force more people to be at home, which meant more revenue for Peloton.

People not going to gyms and fitness centers meant more people purchased Peloton’s at home fitness products, such as their bikes and treadmills, even with a heightened price tag.

While the sudden shift away from “at-home stocks” has caused Peloton’s price to drift, along with other stocks, such as Zoom, there’s many reasons to believe that Peloton’s business model and revenue base may allow it grow further into the future.

For starters, Peloton’s part of a bigger market than just “at-home, lockdown products.” There’s been a years long move towards fitness apps and at-home workouts due to their ease of access and the ability to exercise whenever you want. The home gym market, and even the app exercise market, have grown to become multibillion dollar industries within a few years. Peloton belongs to that market, boasting nearly 3.1 million paid subscribers by June 2020.

There were 64 million gym memberships in the United States during 2019, and there’s a high likelihood that hundreds of thousands, if not millions of those were cancelled during the pandemic. With just a tiny fraction of that number joining at-home options, like Peloton, that can become a large gain for the 3.1 million current Peloton subscribers.

Along with that, investing that membership into something like a Peloton bike becomes a long term investment. A $2000 upfront purchase isn’t something that you forget about when a lockdown ends. As well as becoming a long term investment, the bike ends up becoming your own equipment, removing a need for you to go to a gym in many cases.

Currently, 95% of Peloton’s subscribers come from North America. Along with that, Peloton’s subscribers have very low churn (defined by number of people that leave after joining), generally due to the $39/month Connected Fitness subscription which gives access to Peloton’s services.

According to Peloton’s S-1, the company has a total addressable market of 92 million users, fitting their <$100k income and under 70 years of age, 67 million people who were interested in the company’s products either in the future or at some point, 52 million that were actively interested in future costs, and 14 million households that were interested at current prices and models.

Peloton’s business model

Peloton Interactive sells fitness equipment connected to services, including bikes starting at $1,900 and treadmills starting at $2500. Both of these have access to Peloton’s $39 per month Connected Fitness subscription, which gives product owners access to Peloton’s live exercises and past exercises. The company also has a Digital Membership for $13 per month, which gives access to the classes through mobile devices and TVs.

The company’s “Product and Service” bundles are positioned heavily as an alternative to general exercise equipment as well as to gym and fitness memberships. Even with the company’s premium-priced products, their ecosystem with millions of users, thousands of classes, and hundreds of coaches is a heavy draw and hold for users, which is even price competitive against gym memberships.

The average gym membership for the US sat at $58/month, or a yearly total of $696. The Peloton membership, once past the initial cost, is $39/month, or a ~$220 different yearly.

One of Peloton’s greatest sticking points, is its high growing revenue and sales. Even excluding the pandemic’s boost to the company’s sales, revenue grew from $440 million in 2018 to $1.83 billion in 2020. That means an annual growth rate of over 100%.

Sales including equipment, grew from $350 million to $1.46 billion, with 626 thousand Peloton Bikes and Treads (bikes and treadmiles) sold in 2020 alone. The other rise in revenues came from the company’s growing subscription base, which had grown from 246 thousand households to over 1.09 million.

The base as a whole, including mobile users, met 3.1 million households, with expected revenues growing over 100% again, to almost $3.6 billion.

This would be Peloton’s fourth year of roughly 100% growth, with no signs of slowing down. In connection with growing revenues, the company actually turned a profit this quarter, $89.1 million.

That 89.1 million dollars in profit is a massive swing from a past quarterly lost of $40 million. Peloton says their current goal is not profitability, due to the usual lossy nature of growth companies, but that profit is a positive sign, not only short term, but for long term.

Gross margins are sitting at 47% for FY20, with hardware margins at 43%, which is incredibly impressive. Apple, for example, has a margin of less than 40%, even with its business’ renowned profitability. Along with high margins, Peloton also has slowing operating costs to revenue ratios. While the company’s revenue has been doubling every year, operating costs have not, widening the gap between past losses and current profitability.

Peloton’s created a highly profitable and sticky environment, keeping subscriber retention at 90%+.

The company’s accompanied this through an impressive, premium, product, and their connected fitness subscription. Through their software, thousands compete on a leaderboard as you’re exercising. This little feature in Peloton’s subscription has created a craving for competition, and especially being #1.

This quarter alone, Peloton subscribers worked out an average of 20.7 times per month. That average places subscribers on almost daily exercises. Along with this impressive statistic, the company also pointed out their 0.65% subscription churn rate, which was lower than their already incredibly low 0.9%.

Even with these promising points, there’s still quite a few issues that could arise with the company, mostly relating to post-pandemic culture. These are more simple than some of this post’s ideas, so here they are:

Even with these possible issues, there’s still a lot of good points for the company, especially taking into account Peloton’s quick and reliable growth pre-COVID, as well as the discount that you technically get, over time with a Peloton bike and subscription compared to a gym membership.

These opinions are those of mine exclusively. I have no positions in Peloton, but might initiate a position within the next 7 days. My opinion does not necessarily represent the rest of Statural.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

The fitness equipment company with a strong support base received incredible growth during the pandemic. Here’s why I think that’ll continue.

The fitness equipment company with a strong support base received incredible growth during the pandemic. Here’s why I think that’ll continue.

The fitness equipment company with a strong support base received incredible growth during the pandemic. Here’s why I think that’ll continue.

Peloton, the at-home fitness equipment company (NASDAQ: PTON) has seen its market cap fall by roughly 20% from the past month’s high to its current stock price, after news surrounding vaccines and a return to a pre-COVID world scared many share owners.

The reason behind that drop was due to Peloton’s growth during the pandemic. Naturally, a stay-at-home order/quarantine would force more people to be at home, which meant more revenue for Peloton.

People not going to gyms and fitness centers meant more people purchased Peloton’s at home fitness products, such as their bikes and treadmills, even with a heightened price tag.

While the sudden shift away from “at-home stocks” has caused Peloton’s price to drift, along with other stocks, such as Zoom, there’s many reasons to believe that Peloton’s business model and revenue base may allow it grow further into the future.

For starters, Peloton’s part of a bigger market than just “at-home, lockdown products.” There’s been a years long move towards fitness apps and at-home workouts due to their ease of access and the ability to exercise whenever you want. The home gym market, and even the app exercise market, have grown to become multibillion dollar industries within a few years. Peloton belongs to that market, boasting nearly 3.1 million paid subscribers by June 2020.

There were 64 million gym memberships in the United States during 2019, and there’s a high likelihood that hundreds of thousands, if not millions of those were cancelled during the pandemic. With just a tiny fraction of that number joining at-home options, like Peloton, that can become a large gain for the 3.1 million current Peloton subscribers.

Along with that, investing that membership into something like a Peloton bike becomes a long term investment. A $2000 upfront purchase isn’t something that you forget about when a lockdown ends. As well as becoming a long term investment, the bike ends up becoming your own equipment, removing a need for you to go to a gym in many cases.

Currently, 95% of Peloton’s subscribers come from North America. Along with that, Peloton’s subscribers have very low churn (defined by number of people that leave after joining), generally due to the $39/month Connected Fitness subscription which gives access to Peloton’s services.

According to Peloton’s S-1, the company has a total addressable market of 92 million users, fitting their <$100k income and under 70 years of age, 67 million people who were interested in the company’s products either in the future or at some point, 52 million that were actively interested in future costs, and 14 million households that were interested at current prices and models.

Peloton’s business model

Peloton Interactive sells fitness equipment connected to services, including bikes starting at $1,900 and treadmills starting at $2500. Both of these have access to Peloton’s $39 per month Connected Fitness subscription, which gives product owners access to Peloton’s live exercises and past exercises. The company also has a Digital Membership for $13 per month, which gives access to the classes through mobile devices and TVs.

The company’s “Product and Service” bundles are positioned heavily as an alternative to general exercise equipment as well as to gym and fitness memberships. Even with the company’s premium-priced products, their ecosystem with millions of users, thousands of classes, and hundreds of coaches is a heavy draw and hold for users, which is even price competitive against gym memberships.

The average gym membership for the US sat at $58/month, or a yearly total of $696. The Peloton membership, once past the initial cost, is $39/month, or a ~$220 different yearly.

One of Peloton’s greatest sticking points, is its high growing revenue and sales. Even excluding the pandemic’s boost to the company’s sales, revenue grew from $440 million in 2018 to $1.83 billion in 2020. That means an annual growth rate of over 100%.

Sales including equipment, grew from $350 million to $1.46 billion, with 626 thousand Peloton Bikes and Treads (bikes and treadmiles) sold in 2020 alone. The other rise in revenues came from the company’s growing subscription base, which had grown from 246 thousand households to over 1.09 million.

The base as a whole, including mobile users, met 3.1 million households, with expected revenues growing over 100% again, to almost $3.6 billion.

This would be Peloton’s fourth year of roughly 100% growth, with no signs of slowing down. In connection with growing revenues, the company actually turned a profit this quarter, $89.1 million.

That 89.1 million dollars in profit is a massive swing from a past quarterly lost of $40 million. Peloton says their current goal is not profitability, due to the usual lossy nature of growth companies, but that profit is a positive sign, not only short term, but for long term.

Gross margins are sitting at 47% for FY20, with hardware margins at 43%, which is incredibly impressive. Apple, for example, has a margin of less than 40%, even with its business’ renowned profitability. Along with high margins, Peloton also has slowing operating costs to revenue ratios. While the company’s revenue has been doubling every year, operating costs have not, widening the gap between past losses and current profitability.

Peloton’s created a highly profitable and sticky environment, keeping subscriber retention at 90%+.

The company’s accompanied this through an impressive, premium, product, and their connected fitness subscription. Through their software, thousands compete on a leaderboard as you’re exercising. This little feature in Peloton’s subscription has created a craving for competition, and especially being #1.

This quarter alone, Peloton subscribers worked out an average of 20.7 times per month. That average places subscribers on almost daily exercises. Along with this impressive statistic, the company also pointed out their 0.65% subscription churn rate, which was lower than their already incredibly low 0.9%.

Even with these promising points, there’s still quite a few issues that could arise with the company, mostly relating to post-pandemic culture. These are more simple than some of this post’s ideas, so here they are:

Even with these possible issues, there’s still a lot of good points for the company, especially taking into account Peloton’s quick and reliable growth pre-COVID, as well as the discount that you technically get, over time with a Peloton bike and subscription compared to a gym membership.

These opinions are those of mine exclusively. I have no positions in Peloton, but might initiate a position within the next 7 days. My opinion does not necessarily represent the rest of Statural.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

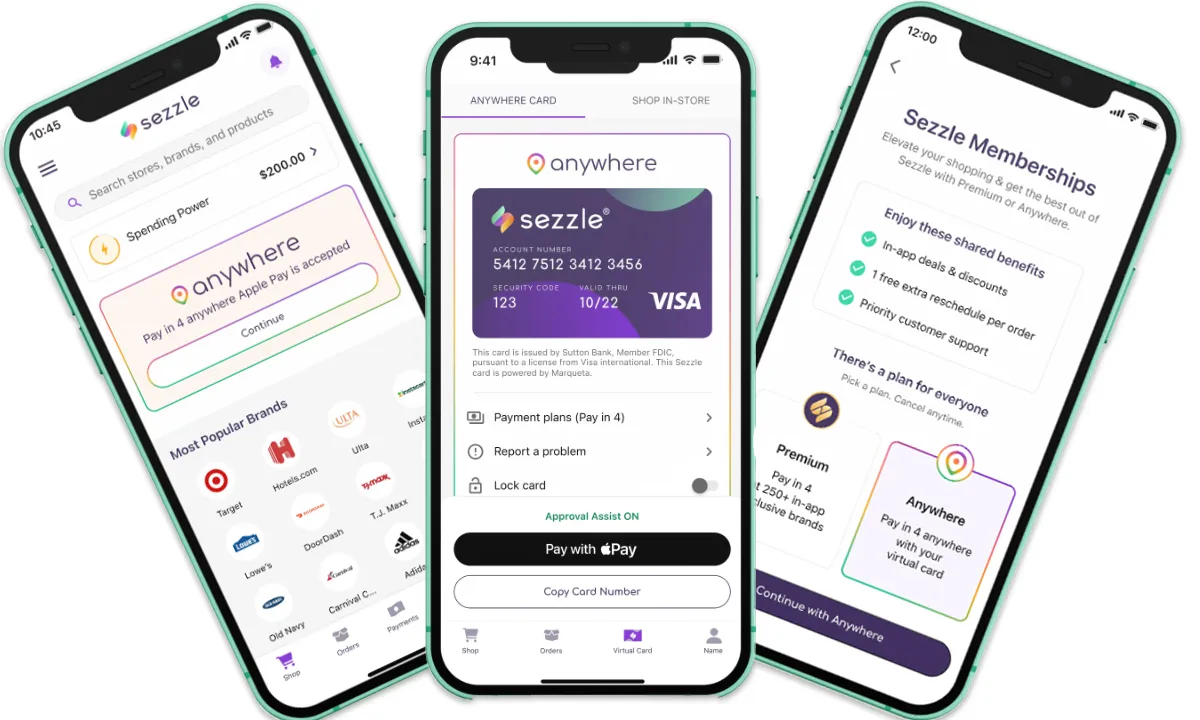

Buy-now-pay-later leader Sezzle shattered Q1 expectations with revenue surging 123% to $104.9M, as net income quadrupled to $36.2M. The fintech company raised 2025 guidance on strong performance across all metrics.