Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

Need a quick recap of today’s stock market moves? Check out Statural.com’s coverage of the biggest moves, key points to notice, and daily updates!

Monday was yet another volatile day for the US stock market, with the S&P 500 and NASDAQ ending the day up 0.06% and 0.20%, respectively, and the Dow Jones and Russell 2K ending down 0.11% and 1.11%.

After hours, you can look forward to Chesapeake Energy, Tilray, and Welltower, among other companies, reporting earnings before starting off Tuesday with a long stream of important earnings calls.

Market Overview: Today’s stock market experienced a mix of movements as investors navigated through a landscape marked by anticipation and cautious optimism. The major indexes, including the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, showed relatively muted activity. This calmness was largely attributed to the market’s wait-and-see approach ahead of the Federal Reserve’s upcoming meeting and the release of earnings reports from several major tech companies later in the week.

Key Gainers: Among the standout performers were McDonald’s and ON Semiconductor. McDonald’s reported worse-than-expected earnings, driven by a rare period of same-store sales shrinkage, but the stock still went up. This positive earnings report led to a significant uptick in its stock price. Similarly, ON Semiconductor saw a substantial rise in its stock value following its earnings announcement, which highlighted robust demand for its products in the automotive and industrial sectors.

Inflation Impact: Earlier in the day, stocks experienced a rebound due to encouraging inflation data. The latest figures indicated a slowdown in inflation, which bolstered investor sentiment and raised hopes for a potential rate cut by the Federal Reserve in the autumn. This positive inflation news provided a temporary boost to the market, as investors speculated that the Fed might adopt a more dovish stance in its monetary policy.

Big Movers: One of the most notable movers of the day was Meta Data (AIU), which saw its stock price double. The surge was driven by a combination of factors, including positive analyst coverage and increased investor interest in the company’s innovative data solutions. Meta Data’s impressive performance stood out in an otherwise subdued market, capturing the attention of traders and analysts alike.

Sector Performance: Different sectors of the market exhibited varied performances. The technology sector, in particular, was in focus as investors awaited earnings reports from giants like Apple, Amazon, and Alphabet. The healthcare sector also garnered attention, with several companies reporting earnings that exceeded expectations. Meanwhile, the energy sector faced some headwinds due to fluctuating oil prices and concerns about global demand.

Investor Sentiment: Overall, investor sentiment remained cautiously optimistic. The market’s subdued activity reflected a sense of anticipation and uncertainty, as traders awaited more concrete signals from the Federal Reserve and upcoming earnings reports. The positive inflation data provided a glimmer of hope, but the market’s reaction was tempered by the broader economic context and ongoing geopolitical concerns.

Looking Ahead: As the week progresses, all eyes will be on the Federal Reserve’s meeting and the earnings reports from major tech companies. These events are expected to provide more clarity on the market’s direction and potential future movements. Investors will be closely monitoring any statements from the Fed regarding interest rates and monetary policy, as well as the performance of tech giants, which have a significant influence on the overall market.

Although the market was volatile as a whole, there were a few stocks that made off with huge gains:

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

Need a quick recap of today’s stock market moves? Check out Statural.com’s coverage of the biggest moves, key points to notice, and daily updates!

Monday was yet another volatile day for the US stock market, with the S&P 500 and NASDAQ ending the day up 0.06% and 0.20%, respectively, and the Dow Jones and Russell 2K ending down 0.11% and 1.11%.

After hours, you can look forward to Chesapeake Energy, Tilray, and Welltower, among other companies, reporting earnings before starting off Tuesday with a long stream of important earnings calls.

Market Overview: Today’s stock market experienced a mix of movements as investors navigated through a landscape marked by anticipation and cautious optimism. The major indexes, including the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, showed relatively muted activity. This calmness was largely attributed to the market’s wait-and-see approach ahead of the Federal Reserve’s upcoming meeting and the release of earnings reports from several major tech companies later in the week.

Key Gainers: Among the standout performers were McDonald’s and ON Semiconductor. McDonald’s reported worse-than-expected earnings, driven by a rare period of same-store sales shrinkage, but the stock still went up. This positive earnings report led to a significant uptick in its stock price. Similarly, ON Semiconductor saw a substantial rise in its stock value following its earnings announcement, which highlighted robust demand for its products in the automotive and industrial sectors.

Inflation Impact: Earlier in the day, stocks experienced a rebound due to encouraging inflation data. The latest figures indicated a slowdown in inflation, which bolstered investor sentiment and raised hopes for a potential rate cut by the Federal Reserve in the autumn. This positive inflation news provided a temporary boost to the market, as investors speculated that the Fed might adopt a more dovish stance in its monetary policy.

Big Movers: One of the most notable movers of the day was Meta Data (AIU), which saw its stock price double. The surge was driven by a combination of factors, including positive analyst coverage and increased investor interest in the company’s innovative data solutions. Meta Data’s impressive performance stood out in an otherwise subdued market, capturing the attention of traders and analysts alike.

Sector Performance: Different sectors of the market exhibited varied performances. The technology sector, in particular, was in focus as investors awaited earnings reports from giants like Apple, Amazon, and Alphabet. The healthcare sector also garnered attention, with several companies reporting earnings that exceeded expectations. Meanwhile, the energy sector faced some headwinds due to fluctuating oil prices and concerns about global demand.

Investor Sentiment: Overall, investor sentiment remained cautiously optimistic. The market’s subdued activity reflected a sense of anticipation and uncertainty, as traders awaited more concrete signals from the Federal Reserve and upcoming earnings reports. The positive inflation data provided a glimmer of hope, but the market’s reaction was tempered by the broader economic context and ongoing geopolitical concerns.

Looking Ahead: As the week progresses, all eyes will be on the Federal Reserve’s meeting and the earnings reports from major tech companies. These events are expected to provide more clarity on the market’s direction and potential future movements. Investors will be closely monitoring any statements from the Fed regarding interest rates and monetary policy, as well as the performance of tech giants, which have a significant influence on the overall market.

Although the market was volatile as a whole, there were a few stocks that made off with huge gains:

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

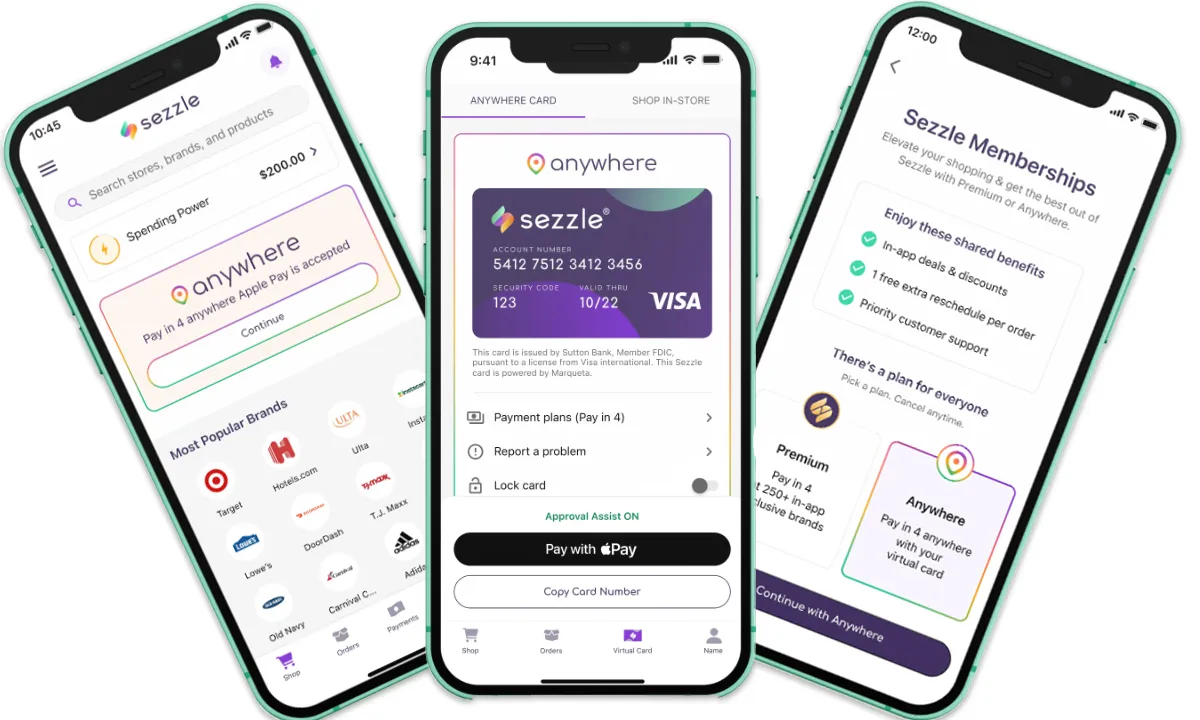

Buy-now-pay-later leader Sezzle shattered Q1 expectations with revenue surging 123% to $104.9M, as net income quadrupled to $36.2M. The fintech company raised 2025 guidance on strong performance across all metrics.