Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

Third Point’s Dan Loeb pressed Intel to make sweeping manufacturing changes in order to bring back lost market share and declining value.

Third Point’s Dan Loeb pressed Intel to make sweeping manufacturing changes in order to bring back lost market share and declining value.

Third Point, the infamous (famous?) activist hedge fund run by Dan Loeb, the activist investor, of which most non-investors likely know from his letter to Disney this year, is urging Intel to explore “strategic alternatives.” Intel’s been on a rough track this year, following losses in market share to AMD and other competitors, as well as losing the title of #1 chip manufacturer to TSMC.

Loeb is well known for his activist approaches to requesting changes within a company, as his hedge fund, Third Point, has the capital to create large enough positions in companies to try to affect change. One of his most notable requests has been to Disney, focusing on streaming as the future for the company.

Third Point has recently amassed quite a large position within Intel, amounting to around $1 billion or 0.5% of the company’s current market cap. Through this power in companies, Loeb and the rest of Third Point can make requests that are more likely to be taken seriously. If small investors with a few shares in a company request change, nothing is going to happen. If a group with over $1 billion invested into your company, you’d be much more likely to listen.

Loeb and the rest of Third Point for that matter, included several considerations for Intel, most notably the request to further outsource production and divest “failed acquisitions.”

Following the announcement of Third Point’s letter to Intel on the behalf of shareholders, shares of the company shot upwards of 8% for intra-day highs. Even with that boost to Intel shares, the stock is still down over 18% this year. This comes against large gains for competitors, AMD and TSMC, with AMD having doubled this year.

“The loss of manufacturing leadership and other missteps have allowed several semiconductor competitors to leverage TSMC’s and Samsung’s process technology prowess and gain significant market share at Intel’s expense,” Loeb wrote. Alongside these missteps, competitor AMD has been eating away at Intel’s once monopolistic share in “core PC and data center CPU markets.”

In a statement surprisingly released the same day, Intel said it would work with Third Point and other investors to increase value for shareholders.

The statement said:

“Intel Corporation welcomes input from all investors regarding enhanced shareholder value. In that spirit, we look forward to engaging with Third Point LLC on their ideas towards that goal.”

Intel as a whole has been severely hurt, both financially and as a competitive force in the chip market, due to a long list of missteps and attacks, including:

ok, you get the point..

Statural covered one of the biggest issues for Intel, Apple’s adoption of their in-house M1 chips, which you can read about here. Apple’s decision to take chips into their own hands, combined with their extraordinary success from that venture, brought Intel’s superiority into question as well.

Loeb added that Intel has to be able to create enticing chips for companies like Apple, mammoth organizations that have the ability to take chips into their own hands. If the company can manage to retain those customers, it can provide the success that it had in the past, as well as create long lasting developmental and financial gains over competitors.

Intel’s already begun to question their previous developmental superiority over their competitors, following an earlier announcement. Early 2020, Intel announced that the company was considering options to outsource manufacturing of its highest end chips. That would free up some manufacturing load on the company and would let it focus on catching up to its competitors.

Third Point seems to agree with this idea, but only to build developmental superiority, and create a technological advantage over its competitors.

Intel’s fallen behind its competitors in chip architecture as well, with Taiwan Semiconductor Manufacturing Co and Samsung Electronics Co taking the lead. TSMC takes contracts from other companies, such as Intel competitors AMD and NVIDIA. Samsung produces millions of pieces of technology.

While TSMC and Samsung have gradually shrunk their transistors to incredibly tiny but high-performance chips, Intel’s met struggles and issues. As seen in the chart above, while Intel is on their 10nm process for the 3rd year in a row, Samsung, TSMC, and even Apple now, have 5nm technology.

5nm is not only more energy efficient, but is also more powerful, and is easier to produce once the technology has been created. These advantages to smaller processes compared to Intel’s 10nm process, have led to many customers and competitors choosing its competitors.

As mentioned earlier, AMD has grown its market share towards besting Intel, the once 90% market share beast. AMD’s latest generation of processers are the most powerful, commercially available, while coming in at the price point of a mid-tier processor of last generation. That combined with AMD’s higher efficiency and more powerful server chips running on 7nm or 5nm, has been hurting Intel hard.

Even with all of these issues arising, most of them are recent and so, Intel hasn’t received much activist attention. The combination of Intel’s large size and its continuously growing revenues, as well as the acquisitions the company has made, has allowed it to avoid major issues with shareholders.

This is in contrary to chip giant (smartphone) Qualcomm. The company had received major activist pressure from Jana Partner LLC in 2015. The company had advocated for breaking up chip-designing and patent-licensing within the company, which was rejected by the company.

While many analysts are confused as to how this split of manufacturing from the company would allow a greater competitive advantage, many are hopeful for some change. Remember, Intel has lost over $60 billion in market value, reflected across millions of shareholders’ portfolios.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

Third Point’s Dan Loeb pressed Intel to make sweeping manufacturing changes in order to bring back lost market share and declining value.

Third Point’s Dan Loeb pressed Intel to make sweeping manufacturing changes in order to bring back lost market share and declining value.

Third Point, the infamous (famous?) activist hedge fund run by Dan Loeb, the activist investor, of which most non-investors likely know from his letter to Disney this year, is urging Intel to explore “strategic alternatives.” Intel’s been on a rough track this year, following losses in market share to AMD and other competitors, as well as losing the title of #1 chip manufacturer to TSMC.

Loeb is well known for his activist approaches to requesting changes within a company, as his hedge fund, Third Point, has the capital to create large enough positions in companies to try to affect change. One of his most notable requests has been to Disney, focusing on streaming as the future for the company.

Third Point has recently amassed quite a large position within Intel, amounting to around $1 billion or 0.5% of the company’s current market cap. Through this power in companies, Loeb and the rest of Third Point can make requests that are more likely to be taken seriously. If small investors with a few shares in a company request change, nothing is going to happen. If a group with over $1 billion invested into your company, you’d be much more likely to listen.

Loeb and the rest of Third Point for that matter, included several considerations for Intel, most notably the request to further outsource production and divest “failed acquisitions.”

Following the announcement of Third Point’s letter to Intel on the behalf of shareholders, shares of the company shot upwards of 8% for intra-day highs. Even with that boost to Intel shares, the stock is still down over 18% this year. This comes against large gains for competitors, AMD and TSMC, with AMD having doubled this year.

“The loss of manufacturing leadership and other missteps have allowed several semiconductor competitors to leverage TSMC’s and Samsung’s process technology prowess and gain significant market share at Intel’s expense,” Loeb wrote. Alongside these missteps, competitor AMD has been eating away at Intel’s once monopolistic share in “core PC and data center CPU markets.”

In a statement surprisingly released the same day, Intel said it would work with Third Point and other investors to increase value for shareholders.

The statement said:

“Intel Corporation welcomes input from all investors regarding enhanced shareholder value. In that spirit, we look forward to engaging with Third Point LLC on their ideas towards that goal.”

Intel as a whole has been severely hurt, both financially and as a competitive force in the chip market, due to a long list of missteps and attacks, including:

ok, you get the point..

Statural covered one of the biggest issues for Intel, Apple’s adoption of their in-house M1 chips, which you can read about here. Apple’s decision to take chips into their own hands, combined with their extraordinary success from that venture, brought Intel’s superiority into question as well.

Loeb added that Intel has to be able to create enticing chips for companies like Apple, mammoth organizations that have the ability to take chips into their own hands. If the company can manage to retain those customers, it can provide the success that it had in the past, as well as create long lasting developmental and financial gains over competitors.

Intel’s already begun to question their previous developmental superiority over their competitors, following an earlier announcement. Early 2020, Intel announced that the company was considering options to outsource manufacturing of its highest end chips. That would free up some manufacturing load on the company and would let it focus on catching up to its competitors.

Third Point seems to agree with this idea, but only to build developmental superiority, and create a technological advantage over its competitors.

Intel’s fallen behind its competitors in chip architecture as well, with Taiwan Semiconductor Manufacturing Co and Samsung Electronics Co taking the lead. TSMC takes contracts from other companies, such as Intel competitors AMD and NVIDIA. Samsung produces millions of pieces of technology.

While TSMC and Samsung have gradually shrunk their transistors to incredibly tiny but high-performance chips, Intel’s met struggles and issues. As seen in the chart above, while Intel is on their 10nm process for the 3rd year in a row, Samsung, TSMC, and even Apple now, have 5nm technology.

5nm is not only more energy efficient, but is also more powerful, and is easier to produce once the technology has been created. These advantages to smaller processes compared to Intel’s 10nm process, have led to many customers and competitors choosing its competitors.

As mentioned earlier, AMD has grown its market share towards besting Intel, the once 90% market share beast. AMD’s latest generation of processers are the most powerful, commercially available, while coming in at the price point of a mid-tier processor of last generation. That combined with AMD’s higher efficiency and more powerful server chips running on 7nm or 5nm, has been hurting Intel hard.

Even with all of these issues arising, most of them are recent and so, Intel hasn’t received much activist attention. The combination of Intel’s large size and its continuously growing revenues, as well as the acquisitions the company has made, has allowed it to avoid major issues with shareholders.

This is in contrary to chip giant (smartphone) Qualcomm. The company had received major activist pressure from Jana Partner LLC in 2015. The company had advocated for breaking up chip-designing and patent-licensing within the company, which was rejected by the company.

While many analysts are confused as to how this split of manufacturing from the company would allow a greater competitive advantage, many are hopeful for some change. Remember, Intel has lost over $60 billion in market value, reflected across millions of shareholders’ portfolios.

Mega-cap tech stocks like Apple, Microsoft, and Amazon dominate markets with innovation in AI, cloud computing, and more, offering high-growth opportunities while influencing global financial trends and shaping future technologies.

CoreWeave posted exceptional Q1 2025 results with revenue reaching $981.6 million, up 420% year-over-year. The AI infrastructure provider secured key partnerships with OpenAI and IBM, while maintaining a 62% Adjusted EBITDA margin. The company’s revenue backlog grew to $25.9 billion, bolstered by OpenAI’s $11.2 billion strategic commitment.

E-commerce giant Shopify delivered exceptional Q1 2025 results with revenue up 27% to $2.36B and operating income doubling to $203M, while maintaining strong merchant growth and platform adoption.

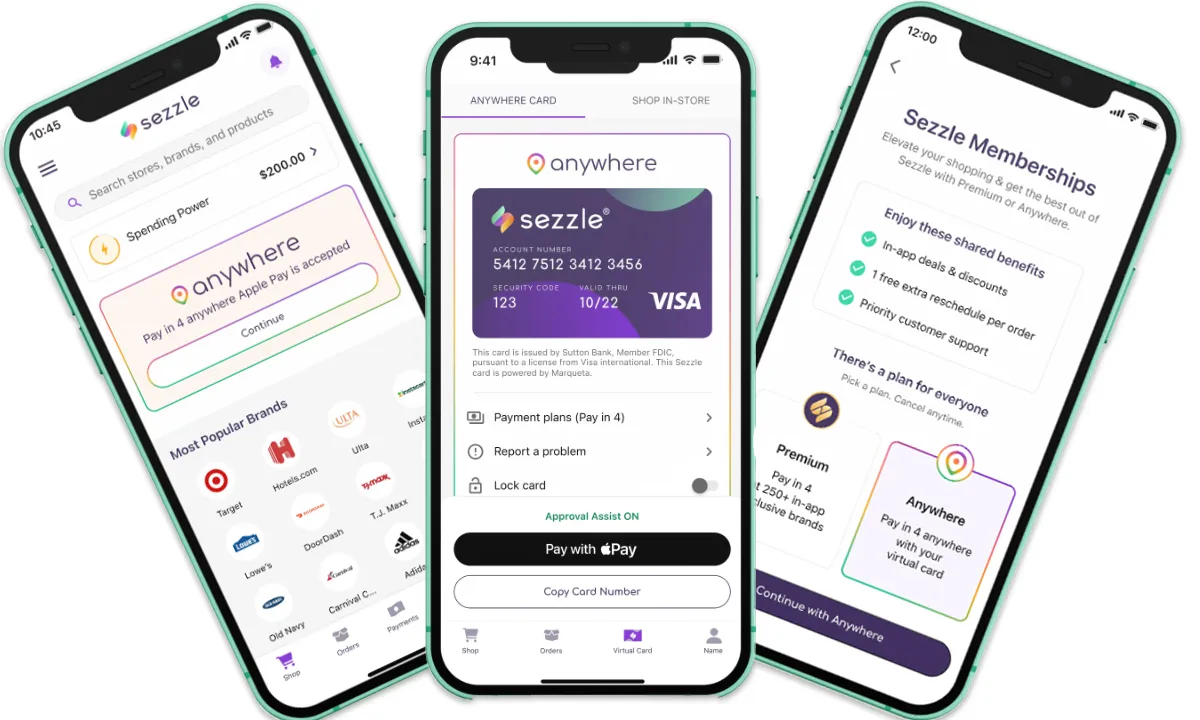

Buy-now-pay-later leader Sezzle shattered Q1 expectations with revenue surging 123% to $104.9M, as net income quadrupled to $36.2M. The fintech company raised 2025 guidance on strong performance across all metrics.